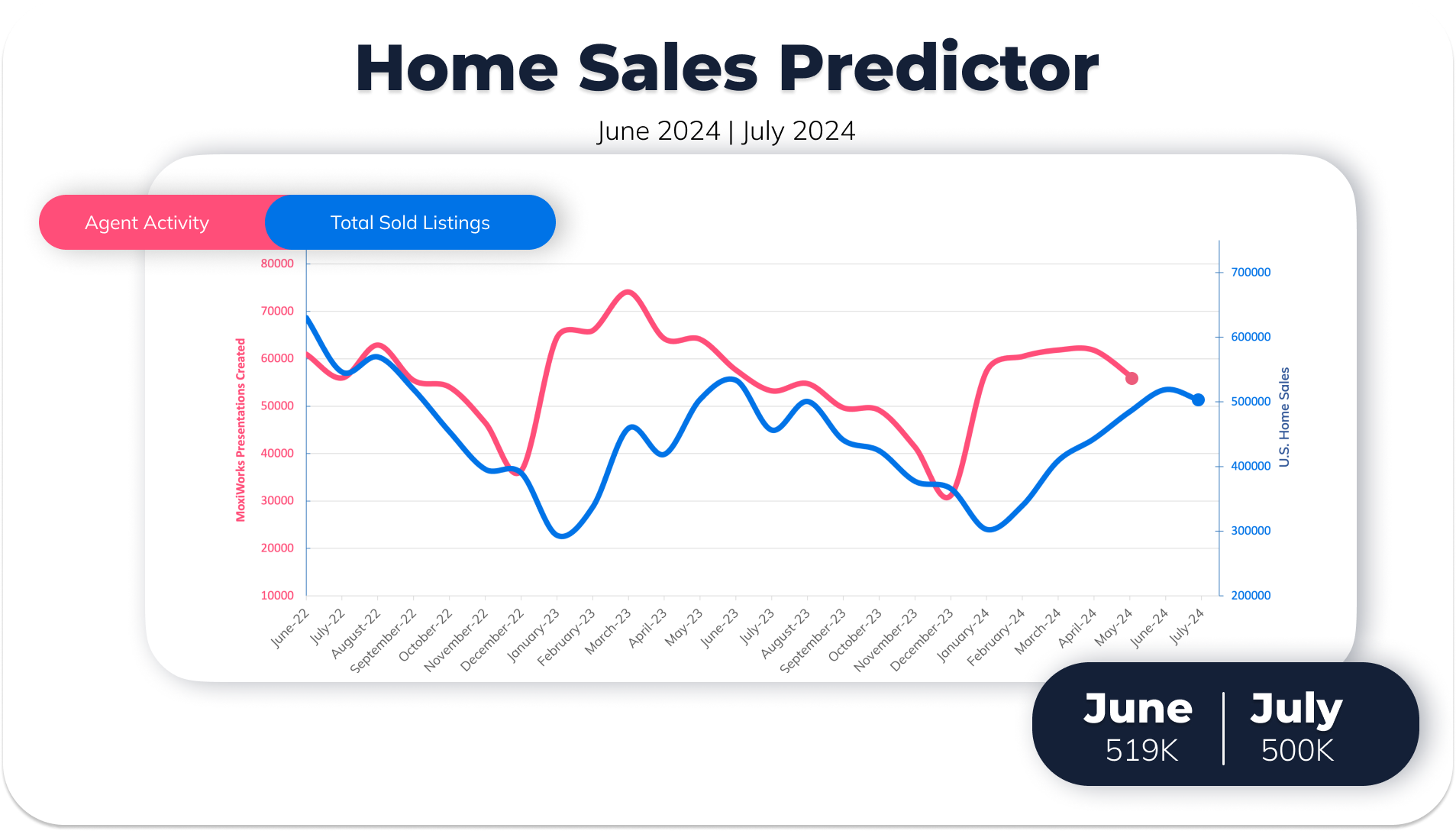

Top things to know this month:

- There were 485K sales in May, a 9% increase from April

- The Home Sales Predictor model is predicting 519K home sales in June and 500K home sales in July

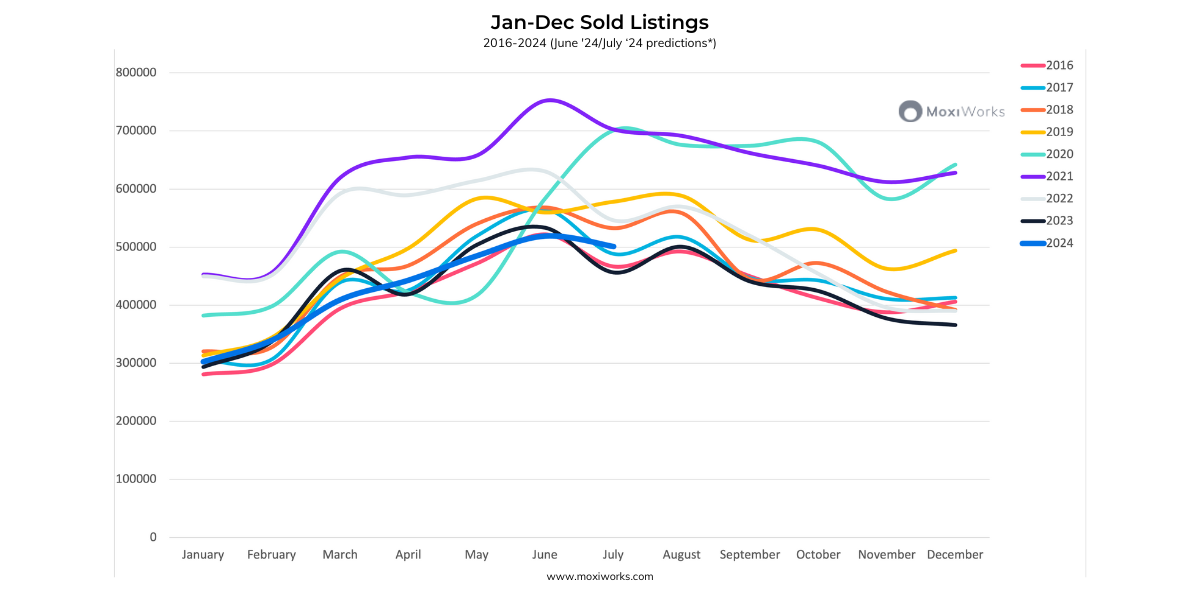

- We’ve made a steady post-pandemic recovery and are seemingly back to a normal market cycle

As the summer season kicks off, the real estate market continues to show dynamic changes. 2024 has been a year of consistent growth in home sales, with each month surpassing the previous in terms of closed transactions. This is certainly a breath of fresh air after what felt like an eternity of the unknown.

Last fall marked what we believe to be the bottom of the market, prompting many to wonder how long we would remain at those low levels before beginning to climb back towards some form of normalcy. We’re happy to report that we now have five months of firm data that show month-over-month increases, indicating a steady recovery. The decline that began in late fall and winter of last year has given way to more typical inventory-constrained market behavior.

So, let’s take a look.

This month, we anticipate a slight increase in home sales, with 519k transactions projected for June, followed by a modest dip to 500k in July. But don’t let that scare you – this pattern aligns with the typical seasonality we experience every year, reflecting the natural ebb and flow of the real estate market.

The slight decline projected for July represents the first dip of the year, yet it still remains within the expected seasonal variations. It’s a reminder that, while the market has been robust, occasional dips are part of the normal cycle and they will happen.

The economy and home buyers alike have seemed to adjust to the reality that the exceptionally low interest rates of the pandemic era are no longer the norm, and they likely never will be again. As we return to a normal market cycle, we expect that these patterns to come are in line with historical seasonal trends.

Despite the current stability, the general feeling has been that the market is low compared to the unprecedented highs of 2020 and 2021. This perception is likely compounded by generational shifts in home buying and changes in buyer capabilities. Recent policy changes by NAR will also impact potential buyers, as they will not be able to roll their agent’s commission costs into their loans. This change will likely edge out those who were just within reach of affording a home.

While these shifts may pose challenges for some, they also present opportunities for others. In particular, the upcoming market conditions could be advantageous for cash buyers who are less affected by the changes in commission policies.

As always, informed and strategic buyers and sellers will find ways to navigate and thrive in the evolving market. Remember, you must plant before you harvest, so keep at it!

Until next month…